“It was the best of wines, it was the worst of wines (apologies to fans of Charles Dickens). The global wine glass seems both quite empty and full to the brim.”

These are the opening lines of my 2011 book Wine Wars and if you change “global” to “California” they apply very well to the situation today. That’s why I will be in Napa Valley next week, speaking at the California Association of Winegrape Growers‘annual meeting summer conference (I’ll paste the conference program at the end of this column). There’s good news for California wine these days and bad news, too.

When is a Drought a Good Thing?

The good/bad – best/worst situation exists in several dimensions. Take the case of water. The on-going drought in California is on everyone’s mind, but its impact has been very different in different regions. The recent news from Napa Valley, for example, is that the drought can be beneficial in terms of wine quality. Smaller grapes, the story goes, produce more intense wines. Good news for those who drink or make Napa Cabernet, we are told.

I can’t tell you how many of my friends have told me how amazing it is that four years of drought are actually good for California wine! Really? Well, I’m amazed too, but because there much more to California wine than Napa Valley. To focus just on Napa and the North Coast as many articles have done is misleading about the overall situation.

Napa Valley produces a lot of wine, but it is more or less a drop in the bucket compared with the huge wine production in other parts of California where the drought situation is very different. Higher costs and lower yields are not good news to most California producers, who are less able to extract a quality premium and suffer falling margins.

Many winegrowers have grubbed up their vines, in fact, switching to higher-value crops in the face of poor winegrape profitability. Paradoxically, however, some farmers are actually switching into grapes from other thirstier or less drought-tolerant crops, presumably because they see scarce water as a long term trend. It’s a complicated situation.

Demand and Supply Apply (As Usual)

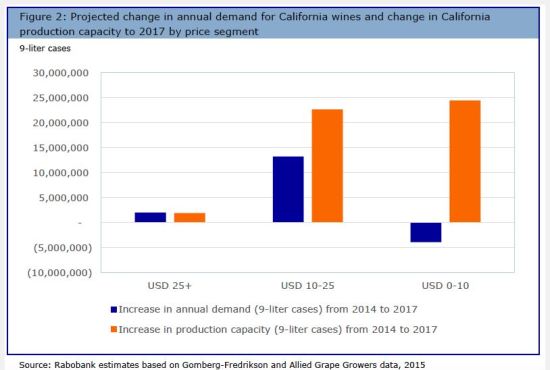

Changing market conditions add to the good news/bad news conundrum. Rabobank reports that the current excess supply situation for under-$10 California value wines (as opposed to higher-price North Coast and mid-price Central Coast wines) is likely to go from a worrisome problem to a real crisis in the next few years, as this graphic suggests.

A recent report by Allied Grape Growers reinforces this message. AGG President Nat DuBuduo noted grape prices as low as $15o per ton in the San Juaquin Valley and as high as $6000 per ton in the North Coast.

Part of the problem is that, for reasons I discussed earlier this year on The Wine Economist, the momentum in wine demand has shifted to premium and super-premium wines with lower-priced wine sales stagnant or falling. At the same time, however, potential production of value wine is about to increase dramatically because of vineyard decisions made a few years ago when market conditions were much different.

Rabobank estimates that 100,000 acres of currently non-producing wine grapes will come into production in the next three years. That my friends is a lot of wine to sell. Where is the increased acreage? Don’t look in Napa Valley, where rising demand and limited supply push prices higher and higher. Some of it is in the Central Coast, according to Rabobank, where demand is rising to potentially match the larger supply.

A lot of it is in the Central Valley when California’s value wines are produced and where prices are already low. This emerging wine lake will add to the current problem of full tanks and lackluster sales of value wines. Bad news for Central Valley winegrowers who are most affected by this pattern.

Best of Wines and the Worst, Too

Best of wines, worst of wines? The Rabobank report suggests a building crisis in one part of the California wine industry while it’s happy days in the North Coast with Central Coast wine seeking to balance rising demand and supply.

My job at the CAWG meetings will be to analyze the international and global aspects of the complicated situation and my remarks will suggests that this is a time of great uncertainty on these fronts, with important risks that might not come from usual sources. Combined with what the other speakers will offer I think it will be a great discussion.

Here’s the agenda for the sessions. Hope to see many of my California wine industry friends in Napa.

>>><<<

CAWG’s Annual Business Meeting & Conference, on Thursday, July 23, 2015

Wine Market Update and Insights explores the interplay between current trends in U.S. wine consumer behavior, the influence of foreign wines in the U.S. market, and what California growers and wineries need to do to stay competitive. Mike Veseth, Editor of The Wine Economist and John Gillespie, Wine Market Council president, will speak.

How Do We Grow the Market for California Wines? Wine consumption in the United States continues to grow, but that growth is unevenly distributed and competition in the domestic beverage alcohol market is fierce. California winegrape growers must compete with foreign wine growers, and domestic producers of craft beers and distilled spirits. This session will consider the current trends, conditions and future views on wine industry growth, consumer demand trends and how growers and wineries must position themselves to compete and grow market share here and abroad. Amy Hoopes, Chief Marketing Officer/Executive Vice President, Global Sales, Wente Family Estates and Rob McMillan, Executive Vice President and Founder Silicon Valley Bank Wine Division, will speak.

Update from Washington, DC will highlight a variety of federal policy issues, including taxes, water, immigration and more. Louie Perry, CAWG’s federal lobbying team member from Cornerstone Government Affairs in Washington, DC, will provide the update.

The View from Trinchero Family Estates will be the luncheon keynote address from Bob Torkelson, president and COO of Trinchero Family Estates. Mr. Torkelson will share his insights and analysis on leading industry trends and issues.

The 41st Annual Business Meeting will take place after the speaker program, during lunch.

Thank you very much for an interesting piece. Could you comment further on what the economic/ grape growing situation was which persuaded people to plant extra acres of vineyards in the Central Valley in the very recent past, i.e. the vineyards that are about to come on stream? On the face of it that was a strange decision given world wide over capacity in the industry and dropping demand for inexpensive wine. Why did it look like a good idea?

Good question, David! It is a complicated situation combining both macro and micro factors. On the macro side, the planting decisions were made when a weak dollar offered some protection from foreign competition. That’s gone now and the dollar is likely to strengthen further if and when the Fed raising rates.

On the micro side, some of the acreage coming online was planting or replanting to match specific grape variety needs. The acreage has been out of production while the vines take hold, but will come online soon. The market environment is different now and unexpectedly unfavorable in many cases. Some of those grapes will be easy to sell because the varieties match current needs, but some will add to the surplus.

A circumstance I witnessed throughout most of Australia in recent years where the grapes were left on the vine, worth less than the cost of harvesting.

Awesome, this article is so good. And can I know more about how the weather affect the grapes growing and the wine supply. I noticed that you mentioned that the Napa valley has limited supply, and central Coast has large supply. Can I know what caused the supply difference between Napa valley and Central Coast. Napa valley is famous as the wine country. And I know the dry weather would make the grape has high sugar content. Is that would affect the wine quality? Thank you!

Stella Pan

The Wine Elite

http://www.wineelite.org/

Thanks for your comment, Stella. Napa’s growth is limited by the fact that it is already densely planted and there are strict regulations that limit future vineyard growth. The Central Coast simply has more room to grow and they are taking advantage of it.

The trend in California is generally to go for fully ripened grapes, so sugar levels are typically quite high by design. Long hang times to develop flavors are the rule (although there are exceptions, of course). The drought’s main impact on the North Coast has been reduced berry size, which translates into a higher skin to pulp ratio and makes possible more intense wines.

Thanks again, Mike