My new book Wine Wars II will be released in just a few days on July 1, 2022, and so. in the spirit of shameless self-promotion, let me remind you that you can order Wine Wars II in paperback or e-book format from Rowman & Littlefield, Amazon.com, and other online and bricks-and-mortar book sellers.

My new book Wine Wars II will be released in just a few days on July 1, 2022, and so. in the spirit of shameless self-promotion, let me remind you that you can order Wine Wars II in paperback or e-book format from Rowman & Littlefield, Amazon.com, and other online and bricks-and-mortar book sellers.

Rowman & Littlefield is offering a 30% discount on Wine Wars II publisher-direct purchases for a limited time. Scroll down to the bottom of this page for details.

Tantor Media will release the audio-book version of Wine Wars II (read by Jonathan Yen) on July 19, 2002. It will be available everywhere audio books are sold. Ten hours of fascinating stories about where global wine is going and how it got there.

A Tale of Two Glasses

Paperback, e-book, audio. Wine Wars II is everywhere!

Wine Wars II updates and extends the most important arguments I made in the original Wine Wars and then adds a new set of chapters on Wine’s Triple Crisis. Each “flight” or set of chapters ends with suggested wine tasting so you can consider the arguments using all your senses. What fun!

Here is a brief excerpt from chapter 1 “A Tale of Two Glasses” for your reading pleasure. It talks about the origins of Wine Wars and the development of Wine Wars II. I think it is interesting that the road to Wine Wars II began with a winery visit about forty years ago, when the problems facing the wine business and the economy more generally were a lot like those we confront today.

HOW I STUMBLED INTO THE WINE WARS

People often ask me how I became a wine economist, an economist who studies the global wine markets. The answer is rooted in a particular time and place. Sue and I were still newlyweds, taking a low-budget vacation in the Napa Valley back in the day when that was still possible. We were headed north on the

Silverado Trail late on our last day, pointed toward our economy motel in Santa Rosa, when we decided to stop for one last tasting.

The winery name was very familiar, and I had high hopes for our tasting. If I had known more about wine back then, I would have recognized this as one of the wineries that kicked French butt in the 1976 Judgment of Paris wine tasting. We pulled off the road and went in to find just the winemaker and a cellar rat at work. No fancy tasting room back then, just boards and barrels to form a makeshift bar. They stopped what they were doing and brought out a couple of glasses. If I knew more about wine back then, I would have been in awe of the guy pouring the wine, but I was pretty much in the dark. So we tasted and talked.

I started asking my amateur questions about the wine, but pretty soon the conversation turned around. The winemaker found out that I was an economics professor. Suddenly he was very interested in talking with me. What’s going to happen to interest rates? Inflation? Tax reform? He had a lot of concerns about the economy because his prestigious winery was also a business and what was happening out there in the financial markets (especially interest rates and bank credit, as I remember) had a big impact on what he could or would do in the cellar. Wineries, especially those that specialize in fine red wines, have a lot of

financial issues.

In addition to the initial investment in vineyards, winery facilities, equipment, and so forth, each year’s production ages for two or three years, quietly soaking up implicit or explicit interest cost as it waits to be released from barrel to bottle to marketplace. The wine changes as it ages, but the economy changes, too. It’s impossible to know at crush what market conditions will be like when the first bottle is sold. Wine economics is a serious concern. Few winemakers are completely insulated from the business side, and sometimes the economy can have a huge effect on what winemakers get to make (if they have the resources to stick with their vision) or have to make (if they don’t).

And so a famous winemaker taught me to think about wine in economic terms and to consider that supply and demand sometimes matter as much as climate and soil when it comes to what’s in my wineglass. I should have known.

Although my interest in wine and economics merged on that Napa day, it sat on its lees for a long time, as I waited for an opportunity to link my personal passion with my professional research agenda. The two naturally converged a few years ago when I began writing what turned out to be a four-volume series

on the global economy. My 2005 book Globaloney: Unraveling the Myths of Globalization includes a chapter called “Globalization versus Terroir,” my first attempt to write about wine economics for a general audience. Globaloney argues that complex global processes shouldn’t be reduced to a few simple

images. Globalization and food are more than just McDonald’s, for example, and globalization of wine isn’t just McWine.

The wine chapter in Globaloney gave me confidence that I had more to say about money, wine, and globalization, so I launched a website called The Wine Economist (WineEconomist.com), where I could work out my ideas in public, make connections, and develop a wine voice. After several years and nearly

200,000 words of blog posts, The Wine Economist evolved into the first edition of this book.

THE ROAD TO WINE WARS II

I wasn’t sure if anyone would want to read about the business of wine, but I was wrong. Wine Wars was warmly received by both critics and readers. It turns out that while wine is good, wine and a story is even better, and stories about the business side of wine can be very interesting. A number of wine industry readers have said that Wine Wars helped them connect the dots and see things more clearly. Consumers, who have no particular business connection, say they just like knowing the backstory of their favorite drink.

I’ve spent the last decade on the wine road speaking at wine industry conferences around the world and learning more about wine and the people who make it. It is a tough job, but someone has to do it, and apparently I am that lucky someone! I have recorded my impressions and experiences in hundreds of columns on The Wine Economist.

Wine Wars has been joined by three other books that continue my analysis of global wine: Extreme Wine (2013); Money, Taste, and Wine (2015); and Around the World in Eighty Wines (2017). Wine Wars celebrated its tenth birthday in 2021, and that occasion made me stop and think (as round-number birthdays sometimes do).

The powerful forces that I identify in Wine Wars are still important, but they’ve changed in ways both big and small. Environmental and demographic shifts, for example, re now much more clearly understood as wine industry challenges. There is a lot to think about and to write about. And so I have written this new book, Wine Wars II, which updates the first edition and extends its argument to address wine’s global crisis.

In a way, this journey has brought me back to that dark cellar on the Silverado Trail in Napa Valley, the great wines we sampled that day, and my “aha!” moment when I realized that wine and economics are a perfect pairing. I’ve learned much more about wine and wine economics, and I appreciate now more than ever the many challenges that the world of wine faces. But I remain an optimist, as I show in this book. I still have grape expectations.

The icons of Italian wine gather in Cortina D’Ampezzo for a few days every other summer to spend some time thinking, talking (and, inevitably, eating and drinking) in contemplation and celebration of their wines. The event,

The icons of Italian wine gather in Cortina D’Ampezzo for a few days every other summer to spend some time thinking, talking (and, inevitably, eating and drinking) in contemplation and celebration of their wines. The event,  Angelo Gaja is famous for the high prices he asked for wines early in his career. People thought he was crazy and some, he told the audience, were even angry with him for asking French prices for his Italian wines. French wines benefited from a reputation for higher quality. Italian wines, even excellent ones like Gaja made, were thought to be in a different, lower class.

Angelo Gaja is famous for the high prices he asked for wines early in his career. People thought he was crazy and some, he told the audience, were even angry with him for asking French prices for his Italian wines. French wines benefited from a reputation for higher quality. Italian wines, even excellent ones like Gaja made, were thought to be in a different, lower class.

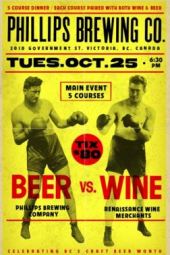

People in the wine business tend to look at each other and see rivals like in the old Mad Magazine Spy vs Spy comic strip. In the battle for shelf space, consumer attention or critical praise, it usually seems like it is wine versus wine.

People in the wine business tend to look at each other and see rivals like in the old Mad Magazine Spy vs Spy comic strip. In the battle for shelf space, consumer attention or critical praise, it usually seems like it is wine versus wine.

I was surprised to learn a couple of weeks ago that

I was surprised to learn a couple of weeks ago that Robert-Elle Skalli, Robert Skalli’s grandfather, built an empire on grain and wine. By the time that Francis Skalli took over from his father after World War II, the family business included a huge grain operation, Rivoire et Carré with a mill in Marseilles, the number two pasta company in France, Lustucru, a vineyard in Corsica, a rice producer, Taureau Aile, and of course vineyards in Algeria.

Robert-Elle Skalli, Robert Skalli’s grandfather, built an empire on grain and wine. By the time that Francis Skalli took over from his father after World War II, the family business included a huge grain operation, Rivoire et Carré with a mill in Marseilles, the number two pasta company in France, Lustucru, a vineyard in Corsica, a rice producer, Taureau Aile, and of course vineyards in Algeria.

tellation), #5 Yellow Tail, #6 Kendall Jackson, #7 Beringer (Treasury), #8 Chateau Ste Michelle, #9 Cupcake (The Wine Group), and #10 Mènage à Trois (Trinchero).

tellation), #5 Yellow Tail, #6 Kendall Jackson, #7 Beringer (Treasury), #8 Chateau Ste Michelle, #9 Cupcake (The Wine Group), and #10 Mènage à Trois (Trinchero).

The title of the seminar was provocative: “In Search Of: Washington’s Singular Style.” Moderator Bruce Schoenfeld of Travel + Leisure magazine wanted to talk about regional wine identity. What does “Washington wine” mean in the wine glass and to consumers in the marketplace?

The title of the seminar was provocative: “In Search Of: Washington’s Singular Style.” Moderator Bruce Schoenfeld of Travel + Leisure magazine wanted to talk about regional wine identity. What does “Washington wine” mean in the wine glass and to consumers in the marketplace?